For first time budgeters, knowing where to start can feel intimidating.

Believe me, I’ve been there! There are so many different categories of purchases that we make. It can be so hard to classify the things that we pay for, or know how much we should be spending in certain areas. Luckily, I was introduced to the 50/30/20 rule early on in my personal finance journey. The 50/30/20 rule is an easy budgeting technique that assists you in sorting out your expenses into three categories, and determining how much should be spent in each area ideally. It helped me create a roadmap to save money and track my expenses, and thus, made it easier to identify when I went over budget during certain pay periods. Does this sound intriguing to you? Let’s take a deeper dive into the 50/30/20 rule!

Now that you know the gist of the 50/30/20 rule, it’s time to get specific. What exactly does it mean?

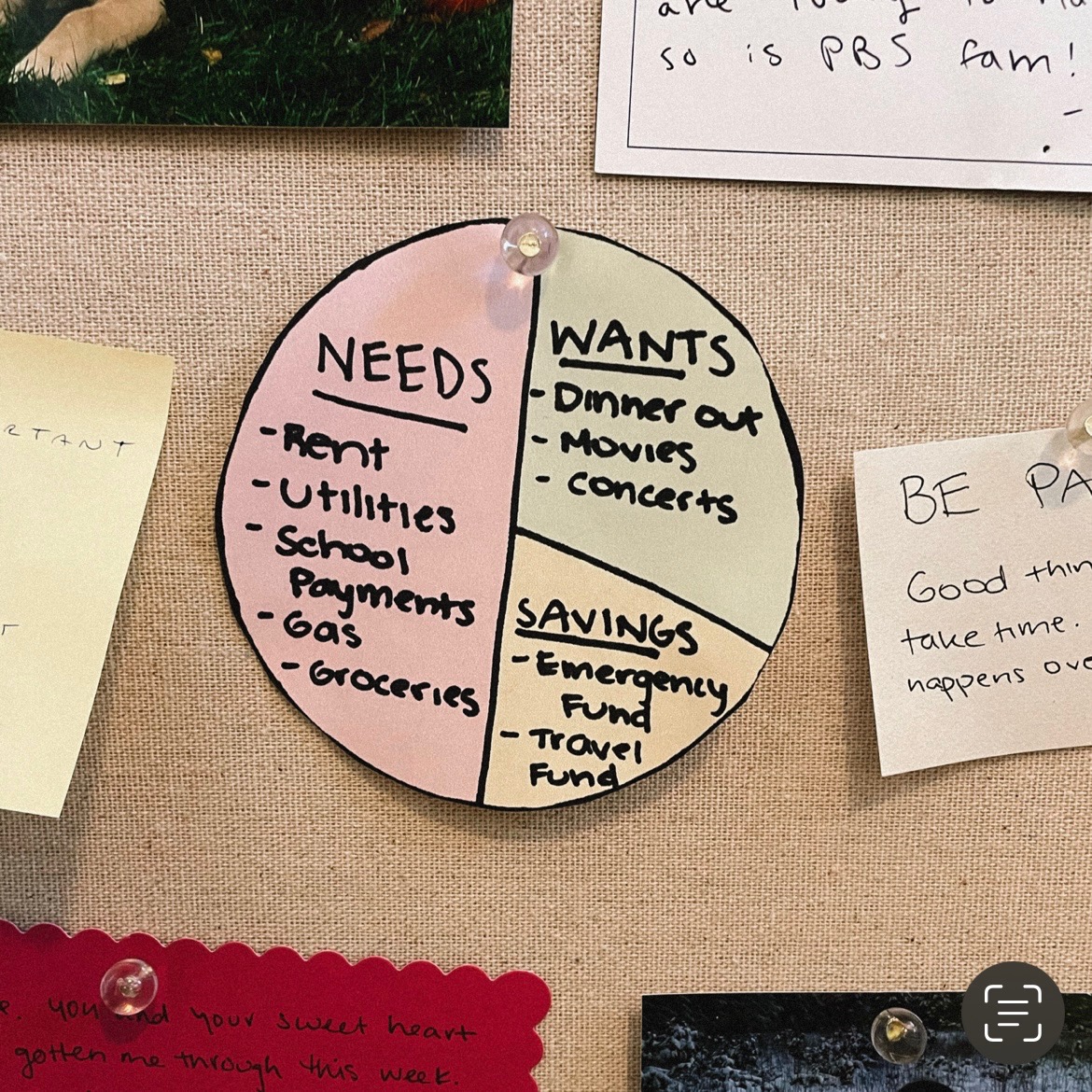

The 50/30/20 rule is a way to break down your paycheck into categories. Each category is then assigned a percentage. This way, you can try to allot a target amount to each category based on your income. In order to stick to your budget, your spending in each category should not exceed the target amount. So, what are the categories and percentages?

According to the 50/30/20 rule:

- About 50% of your income should go to your needs. This includes things such as housing expenses, utilities, transportation expenses, and groceries.

- About 30% of your income should go to your wants. This could include takeout, entertainment, nights out with friends, books. Basically, whatever you want!

- The last 20% of your income should go to savings goals. This could go towards a sinking fund, your emergency fund, your 401k, your Roth IRA, or a high yield savings account. Whatever your working towards saving for, 20% of your income is a good place to start for contributions!

Let’s take a bi-weekly paycheck of $1000 as an example.

Every two weeks, you are obtaining $500 to put toward your needs, $300 to put toward your wants, and $200 to put toward savings. You can easily use this to gauge how much you can spend in certain areas of your life. For instance, you probably won’t want to be spending the bulk of your “needs” money on housing, since you also need the other things that fall under that category. In order to make sure you can meet your needs, you should try to minimize your housing costs. If, for instance, $300 sounds like far too much money to spend on things that you want, you could decide to increase the percentage you spend on needs up to 60%. You could then lower the “wants” percentage to 20%. That leads me to the best part of the 50/30/20 rule: it is entirely customizable.

If the 50/30/20 rule doesn’t make sense to apply in your life, you could always try adjusting the percentages. Budgeting has no strict rules, and is really just a tool to help you figure out the best way to manage your finances. If a 60/30/10 rule or a 40/30/30 rule works better for you, then use those percentages instead! It’s entirely up to you.

Did this blog bring about any additional questions for you? Ask them by clicking this link here and I’d be glad to answer! If I don’t quite know the answer, I’d be happy to do some research and find it for you. We’re all here to learn and grow, including me. As always, thank you for reading!